Blog Navigation: Business Insights and Spotlights | Chamber Blog

10.06.25

Minnesota Paid Family and Medical Leave: What Employers Need to Know

By Cale Dunwoody, Vice President of Public Policy, FMWF Chamber

Attendees gathered on Monday, Sept. 15, 2025, to hear Greg Norfleet, Director of Paid Leave at the Minnesota Department of Employment and Economic Development (DEED), discuss key details of Minnesota’s Paid Family and Medical Leave program.

Learn how Minnesota Paid Family and Medical Leave affects employers, coverage, benefits and compliance before the 2026 rollout.

Starting January 1, 2026, Minnesota workers will have access to a new statewide benefit: Paid Family and Medical Leave (PFML). This program, administered by the Department of Employment and Economic Development (DEED), will change how employers and employees handle time away from work for major life events. The Chamber recently hosted an employee engagement session, where business leaders got an overview of the program, current updates and answers to many of the questions they had surrounding the program.

For business leaders, the time to prepare is now. Here’s a clear overview of the basics you need to know.

What is Minnesota Paid Family and Medical Leave (PFML)?

PFML is a state-run program that provides partial wage replacement and job protection for eligible employees who need to take leave for family or medical reasons.

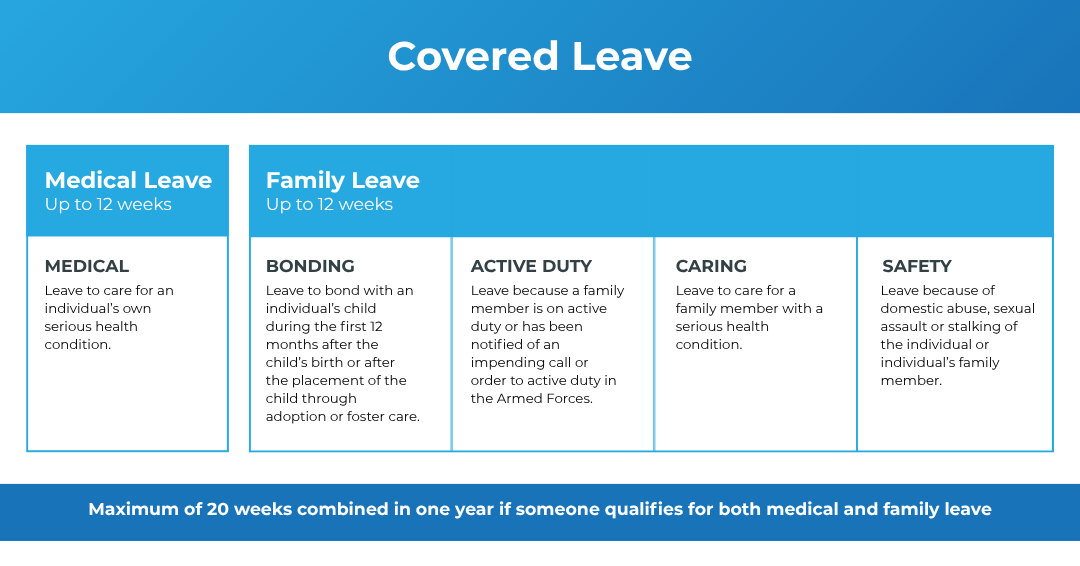

Types of Leave Covered Under Minnesota PFML

Employees can take up to 12 weeks of medical leave and 12 weeks of family leave within a 52-week period, with a maximum of 20 weeks total. Covered reasons include:

Important: Qualifying conditions must last more than seven days and be certified by a health care or other specified provider.

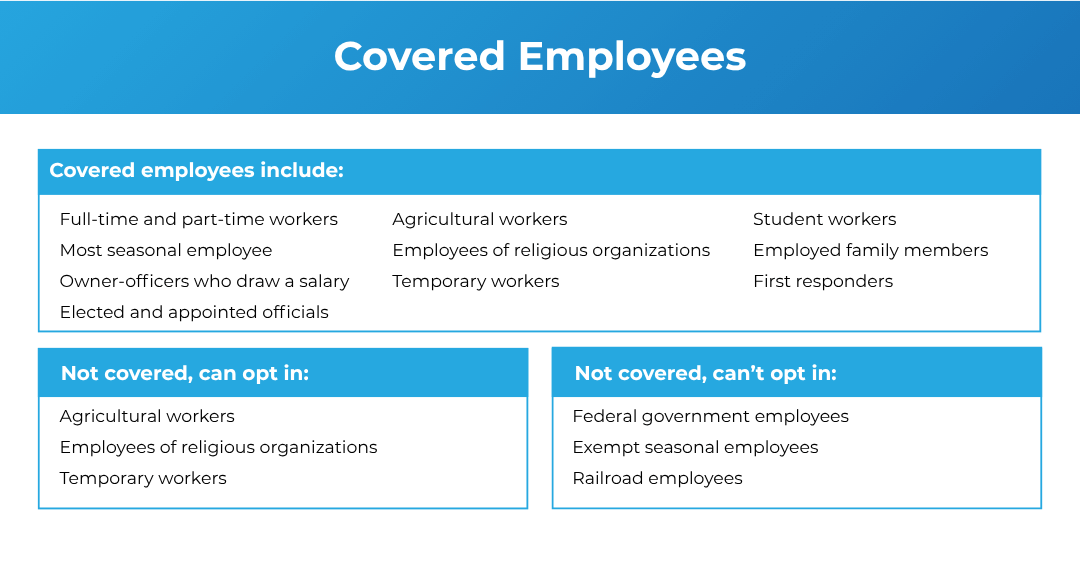

Who is Covered Under PFML?

Most Minnesota workers are covered, including:

Minnesota PFML and Cross-Border Employees

Coverage depends on where the work is performed. Employees who spend at least 50% of their work time in Minnesota are eligible for the program. If an employee performs at least 50% of their work in another state, other than Minnesota, they are not eligible for Minnesota’s PFML program. However, if an employee does not meet the 50% threshold in any single state, then eligibility is determined by the employee's residency.

Examples:

- Eligible Employees:

- An employee is based in Minnesota who performs at least 50% of their work in Minnesota → Covered.

- An employee based in North Dakota who performs at least 50% of their work in Minnesota → Covered.

- An employee based in North Dakota who performs work across multiple states and does not reach the 50% threshold in one single state, but they live in Minnesota→ Covered (due to employee residency).

- A remote worker living in Minnesota who performs at least 50% of their work from their home in Minnesota → Covered.

- Non-eligible Employees:

- An employee based in North Dakota who performs at least 50% of their work in North Dakota→ Not covered.

- An employee based in Minnesota who performs at least 50% of their work in North Dakota → Not covered.

- An employee based in North Dakota who performs work across multiple states and does not reach the 50% threshold in one single state, but they live in North Dakota→ Not Covered (due to employee residency).

How Much Will Employees Receive Under PFML?

Benefit payments are made directly by the state, not by employers. Workers can receive:

- Up to 90% of the state’s weekly average wage, capped at $1,423 per week (based on 2025 numbers).

- Wage reimbursement percentages are based on income levels; lower-wage workers receive a higher percentage of wage replacement (up to 90%).

To qualify, an employee must have earned at least 5.3% of the statewide average annual wage in the past year (about $3,900 in 2025).

If you receive payments from Unemployment Insurance, Workers’ Compensation or Social Security Disability Insurance during an absence, you are not eligible for Paid Leave payments.

Key Employer Responsibilities for Minnesota PFML Compliance

- Employers must notify their employees about Paid Leave benefits by Dec. 1, 2025.

- Employers can elect to provide these benefits through a private or self-insured plan.

- Premiums will begin Jan. 1, 2026.

- Eligible employees can begin taking leave starting Jan. 1, 2026.

- First quarterly premiums are due by April 30, 2026.

- Employees are generally afforded certain job protection, including job or equivalent position restoration, continued employer contribution of health care premiums, and protection against retaliation or interference for taking leave.

Key Takeaway: Nearly every business operating in Minnesota will be impacted by this new program. Understanding who is covered, what types of leave qualify and how benefits are paid will set you up for compliance — even if you are based in another state.

Next up in this blog series: We’ll break down premiums, taxes and employer costs so you can budget and plan ahead.

Stay Engaged Through Chamber Advocacy

The Chamber has been tracking the Paid Family and Medical Leave legislation since its introduction, voicing the business community’s concerns and pushing for clarity. We know this law will create challenges for employers, and we are here to help you navigate them.

To stay connected:

- Subscribe to Advocacy in Action – Get weekly updates on key policy issues that affect your business and stay informed about new compliance resources. Sign up for Advocacy in Action and get updates delivered straight to your inbox.

- Contact Cale Dunwoody, Vice President of Public Policy – Have specific questions about how Minnesota Paid Family and Medical Leave impacts your organization? Email Cale directly at cdunwoody@fmwfchamber.com to share your feedback or request guidance.

- Attend Chamber public policy events – Hear directly from policymakers, learn how new laws impact employers and add your voice to the discussion. View upcoming public policy events and register to make sure your business is represented.

Your involvement strengthens our collective advocacy. Together, we can ensure Minnesota businesses remain informed, prepared and competitive.

View the full MN DEED Paid Family and Medical Leave presentation from the Sept. 15 engagement session.

Disclaimer: Please consult a human resource professional or lawyer to ensure you are in compliance.

SHARE

More Stories

Upcoming Events

Subscribe to email newsletters